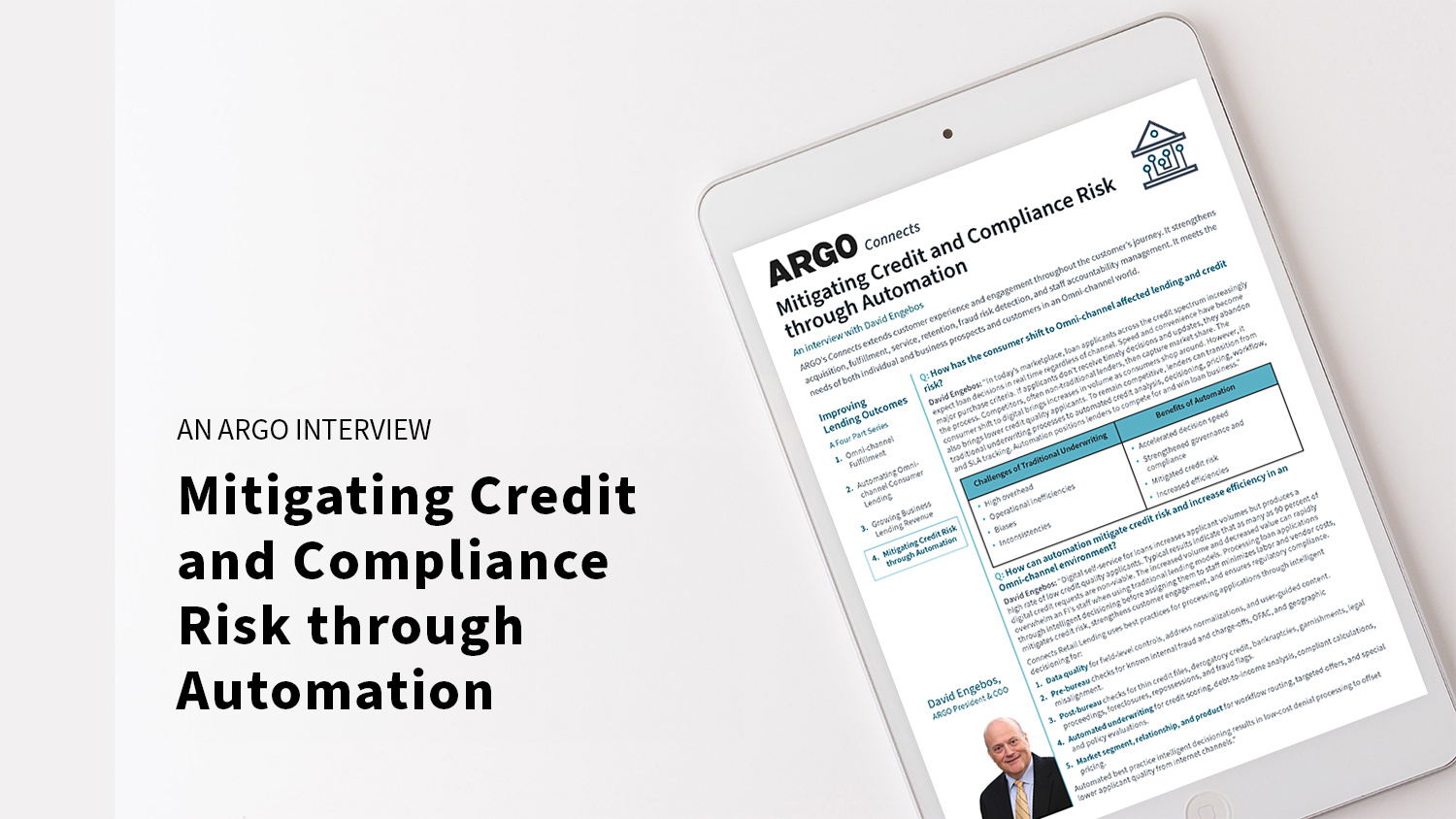

Using automation to mitigate credit risk and increase efficiency in an Omni-channel delivery environment

ARGO Connects Retail Lending provides seamless origination, decisioning, processing, and closing for all types of consumer, real estate, and business loans, improving efficiencies, streamlining customer-to-banker collaboration, and reducing credit and compliance risk.

Financial institutions gain a competitive advantage by mitigating credit risks in an Omni-channel delivery ecosystem with Connects automation that:

- Strengthens governance and compliance

- Reduces operational cost

- Accelerates decision speed

- Improves customer and banker experience

- Enables automated decisioning analytics

Download the Mitigating Credit and Compliance Risk through Automation interview brief to explore how ARGO can help your financial institution improve lending outcomes.