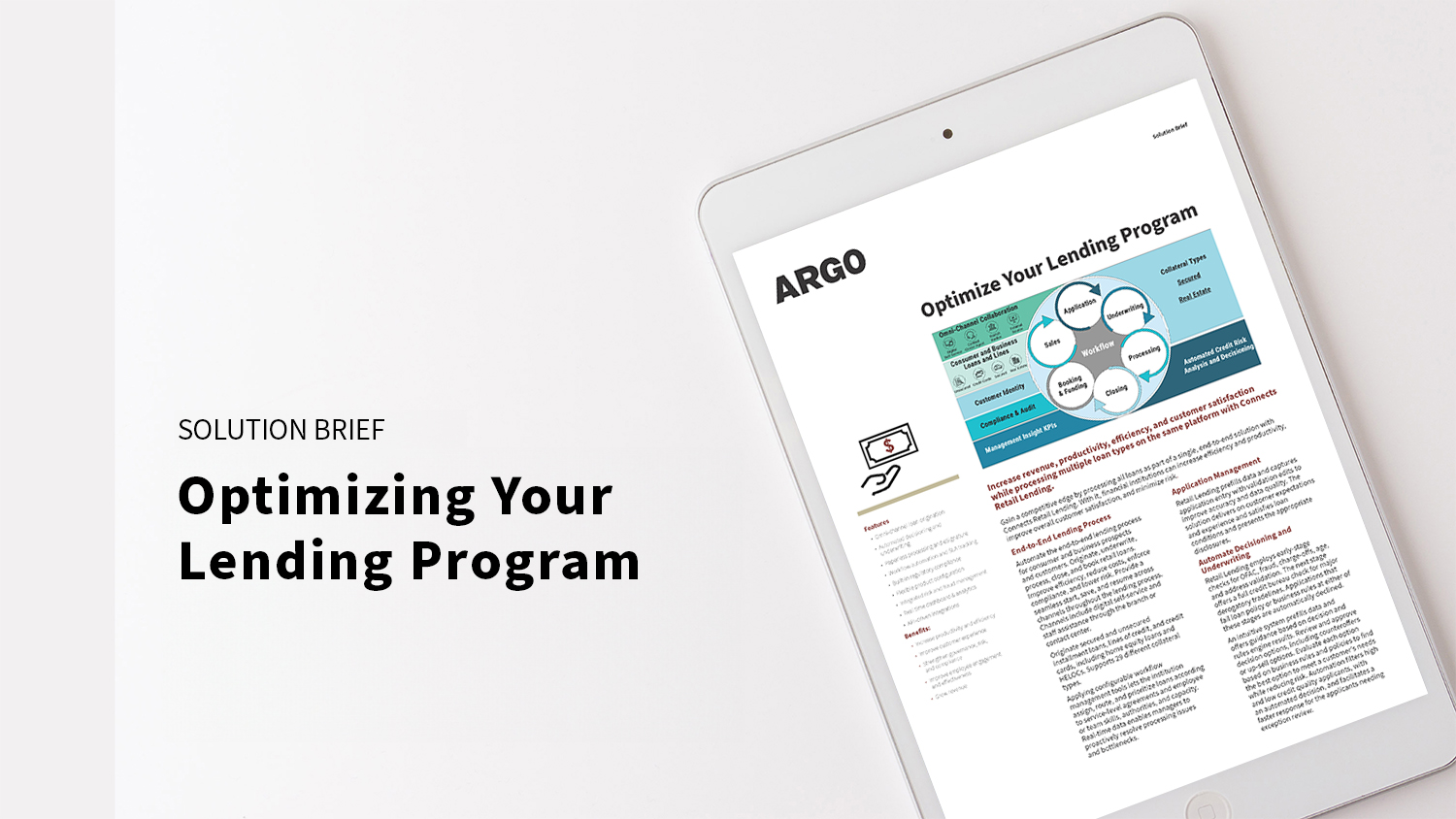

Increase revenue, productivity, efficiency, governance, and customer satisfaction, all while processing multiple loan types on the same platform

Financial institutions historically keep consumer loans, real estate loans, business loans, and indirect loans separate and process them using different loan origination and decisioning platforms. However, this process often results in decreased productivity, increased costs, substantial process and delivery gaps, and less than desirable customer experiences. To effectively manage consumer loans, processing multiple loans as part of a single, end-to-end solution can increase efficiency and productivity, improve overall customer satisfaction, enhance governance, and minimize risk.

Key benefits of ARGO’s Retail Lending solution include:

- Increase productivity and efficiency

- Improve customer experience

- Strengthen governance, risk, and compliance

- Improve employee engagement and effectiveness

- Grow revenue

Download ARGO’s retail lending solution brief to learn how your organization can better manage all loan types and deliver an outstanding customer experience.